”Pinili ko si Tala kasi hassle-free sila. Isang valid ID lang ang hiningi nila, at hindi rin mataas ang interest rates nila.”

Alyne

Sasamahan kang lumaban

ng patas sa buhay.

Enjoy your full loan amount without any fees

Apply and borrow money in minutes.

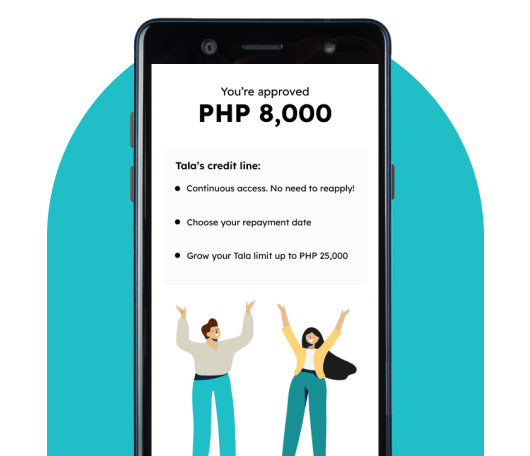

Unlock instant reapproval with on-time repayment and watch your Tala limit grow up to ₱25,000.

Your personal information is secure with state-of-the-art SSL encryption and our SEC & BSP registration.

Did you know almost 90% of people in a recent survey said their ability to manage finances improved after using Tala? Read the latest report on Tala’s impact globally here.

Enjoy Tala credit limits up to ₱25,000 with no hidden fees.

Apply within minutes, receive an instant decision, and cash out from disbursement channels nationwide.

Choose your own repayment date up to 61 days and gain control over your finances with Tala.

”Pinili ko si Tala kasi hassle-free sila. Isang valid ID lang ang hiningi nila, at hindi rin mataas ang interest rates nila.”

Alyne

”Para sa akin, si Tala ay sunshine. Na-inspire akong mangarap pa para sa negosyo ko.

Ailyn

”Nakuha po ni Tala yung tiwala ko kasi nagstart po ako sa pinakamababang offer, from Php 200 umakyat na po sa Php 4,000, ngayon po nasa Php 8,000 na po yun.

Hector