Tala Flexible Loans Frequently Asked Questions

Flexible loans your way

Why choose Tala loans?

Tala loans empower you with flexible financial access and the opportunity for growth. Whether you rely on Tala on a regular basis to supplement your income or you simply want to increase your access to credit to prepare for a rainy day, you can count on Tala to help you build financial security and agency.

We’re not a simple loan provider – we strive to be your financial partner and help guide you through the ups and downs of managing your finances.

How can I increase my loan limits?

Paying on time keeps you in good standing with Tala, which allows you to increase your loan limits over time. Your first loan with Tala is only the initial stepping stone! When you consistently pay on time and remain in good standing, you see your loan limits climb higher and higher. Read this blog post on the many benefits of repaying on-time.

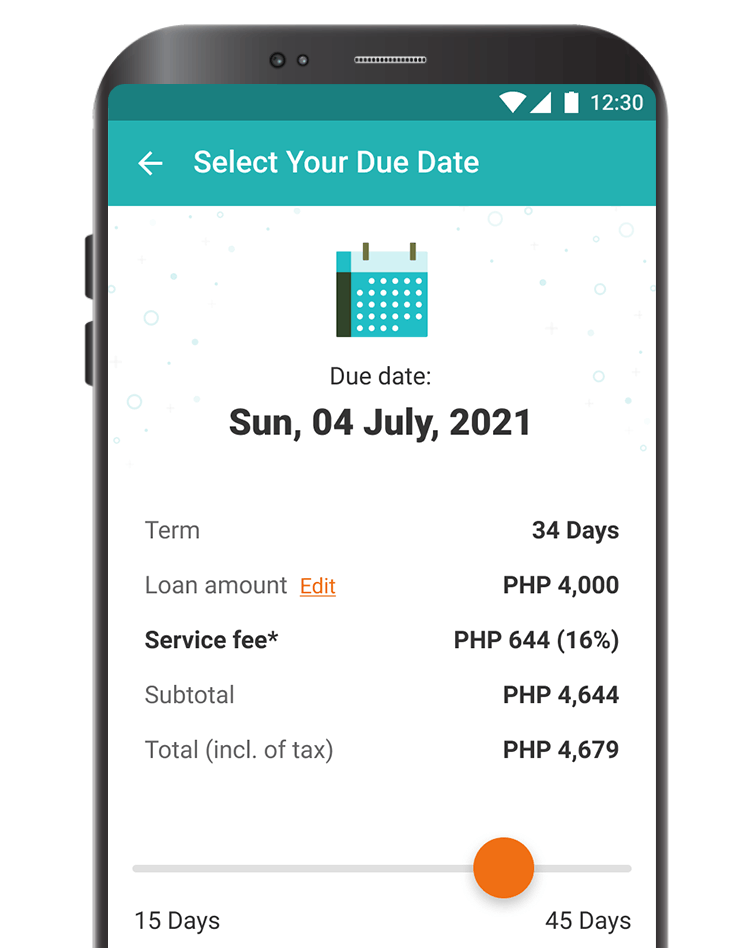

What are the payment terms for Tala’s new flexible loans?

We understand how important it is to pick a due date that aligns well with your income cycle and foreseeable financial commitments, so Tala now gives you the flexibility to choose any repayment date between 15 and 45 days that aligns with your needs and ability to pay.

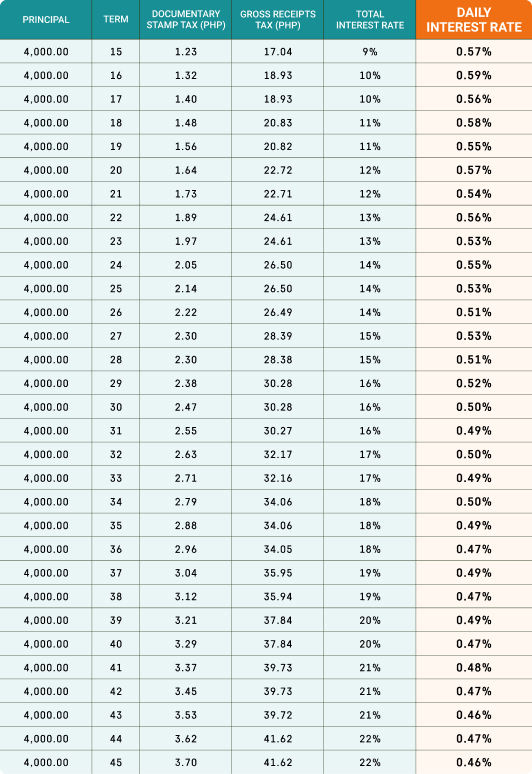

The interest rate for your loan will depend on the loan duration you choose. Depending on your financial situation, you can opt for a short 15 day loan to get as low as 9%, but if you need a longer term you can choose until 45 days where daily rates also go lower. Refer to the below table for reference.

Why is Tala offering this new flexible loan?

Many of our customers have told us that increased flexibility would help them align the repayment due date with their income cycles and other financial obligations, so we listened.

We know you know best when it comes to picking a due date that aligns well with your income and your ability to repay on time. With this new flexible loan, you can enjoy increased choice and control with loans on your own terms, between 15 and 45 days. Choose wisely and keep growing with Tala!

Tips for success

Do I need to update my Tala app to get the new flexible loans update?

Yes, updating your Tala app to the latest version will allow you to enjoy the benefits of Tala’s new flexible loans.

How do I select the right repayment due date?

You should always choose a loan amount and due date that you’re confident you’ll be able to repay on time. When selecting your repayment due date, we recommend that you carefully consider your income cycle and foreseeable financial commitments. You can read more tips about how to select the right due date here.

How do I select the right loan amount?

Even if you are approved for more money than you need to borrow, there is no obligation to borrow the full amount. In fact, we recommend that you start small and only borrow what you need. Always borrow an amount that you’re comfortable with and confident that you will be able to pay back on time.

Repay on time, and grow with Tala

Where can I repay my loan?

Tala has partnered with several payment channels, which allows you to pick the repayment option that is easiest for you. If you want to pay safely from your home, you can choose to pay via GCash, Coins.ph, or PayMaya. If you don’t have these mobile payment apps on your smartphone, you can go to authorized payment locations such as 7-Eleven, M Lhuillier, and Cebuana Lhuillier.

Please make sure that you pay only using our authorized payment channels and retrieve your reference number from your Tala app.

Can I make payments before my selected due date?

Yes, you can make loan payments before your due date! In fact, paying your loan earlier can make you eligible for a reloan or a higher loan amount.

Can I pay in installments?

Yes, you can pay in installments until you fully pay your loan, as long as all payments are made by your due date.

If I pay earlier than the selected due date, will my interest rate change?

The interest rate that you select when you apply for the loan is a fixed rate, which does not change if you pay earlier than the due date.

Repayment Trouble

If I know I cannot pay my loan on time, what should I do?

We understand that sometimes unpredictable circumstances can prevent you from paying on time. When you know that you may have trouble repaying on time, we would encourage you to pay down your loan as much as you can through partial payments and contact us as soon as possible at support@tala.ph.

When the going gets tough, Tala is there for you. Our Customer Advocates do their best to work with you to find a fair resolution. The most important thing is to reach out early if you have questions or concerns about repayment and to keep an open line of communication.

What happens if I pay late? Is there a late fee?

We strongly encourage you to select a due date that aligns with your income cycle and to repay your loan on or before your selected due date. You can also make partial payments to reduce your balance. However, if you aren’t able to pay by midnight on your due date, you will be charged a one-time 8% late fee on your outstanding balance. While other lenders charge a late fee for every day that you are late, Tala’s only charges a one-time late fee and the sooner you pay back, the better your chances of getting another loan with Tala.

Will you contact my friends and relatives if I don’t pay on time?

We assure you that your information is confidential and secure. We respect your privacy and will never contact your friends and relatives. The email address, the primary phone number and the optional alternate phone number that you register with Tala are the only contact information that we will reach out to so kindly make sure that they are active or updated.

Access to next loan

Can I apply for a new loan while I still have a remaining balance?

You can apply for a new loan as soon as you pay the full amount of your existing loan. Make sure to fully pay for your Tala loan on your due date for more chances of getting a reloan.

Tala is operated by Tala Financing Philippines Inc., a licensed financing company with SEC Registration No. CS201710582 and Certificate of Authority No. 1132. Always study the terms and conditions and the disclosure statement before proceeding with any loan transaction.