Online scams are evolving—and fast. From phishing emails to deepfake impersonations and forged PhilSys IDs, fraud is getting more sophisticated, targeting vulnerable consumers across the country. But as threats grow, so does the need for collective action.

Tala Philippines joined government leaders, industry experts, and digital risk professionals at the Decoding Deceit: A Financial Fraud Forum to sound the alarm and strengthen defenses against financial fraud in the country. Organized by the Consumer Lending Association of the Philippines (CLAP), the forum brought together voices from the Securities and Exchange Commission, Bangko Sentral ng Pilipinas, National Privacy Commission, Cybercrime Investigation and Coordinating Center, Credit Information Corporation, and the Philippine National Police to share frontline insights and push for real-world, unified responses to fraud.

“When there’s money to be earned, scammers will follow. It’s our job to stay ahead,” said SEC Commissioner Rogelio Quevedo, as he emphasized the need for collaboration among government agencies, tech platforms, and financial service providers.

Fraud Is a Barrier to Financial Inclusion

Fraud doesn’t just harm individuals—it slows down national progress. According to the Cybercrime Investigation and Coordinating Center (CICC), 32% of reported cases in 2024 were digital fraud-related, translating to ₱198 million in total losses—more than three times higher than the previous year.

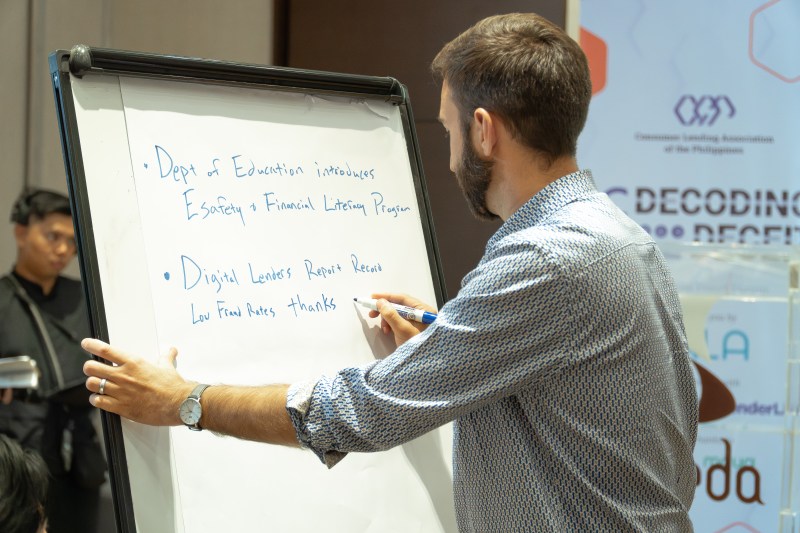

Tala’s Global SVP of Credit, Patrick Yoder, shared how these fraudulent activities impact financial inclusion efforts.

“Fixers and impersonators aren’t just defrauding companies. They’re driving up default rates, tightening approval processes, and ultimately making it harder for first-time borrowers to trust formal finance,” he said.

The rise in scams also discourages acceptance of tools like national IDs and secure digital payments, especially when public trust is undermined.

The Power of Digital Literacy and Coordinated Legal Action

A core insight from the forum: scammers often exploit human vulnerability, not just technical loopholes. That’s why Tala is doubling down on digital literacy alongside financial education.

“Digital identity is the gateway to financial services. If we want Filipinos to access opportunities, we need to teach them how to protect and manage that gateway,” said Arianne Ferrer, Tala Philippines’ External Affairs Director and President of CLAP.

Through programs like TALAkayan with Salve Ibañez, Tala continues to equip customers with real-world knowledge to spot scams, avoid fraudsters, and confidently navigate the digital economy.

But education alone isn’t enough. Experts at the forum also called for:

- Stronger legal deterrents by filing criminal cases,

- Cross-agency coordination for tracing fraud networks,

- And publicizing cases wins to discourage repeat offenders.

Ferrer emphasized Tala’s commitment:

“We’ve already filed some of the first criminal cases under the Anti-Financial Account Scamming Act. We will continue to hold fraudsters accountable and defend our customers at every turn.”

Tala’s Ongoing Commitment to Consumer Protection

Tala doesn’t just respond to fraud—we proactively fight it.

- We use AI and machine learning to detect suspicious behavior,

- Routinely update privacy safeguards,

- And monitor social media for new scam tactics targeting customers.

By combining data-driven security systems with human-centered education, Tala is creating a safer space for Filipinos to access, build, and grow their finances.

“At Tala, protection means action. From legal measures to literacy programs, we’re building a trustworthy credit system where every ka-Tala can confidently pursue their financial freedom,” said Ferrer.

Empowering Filipinos, Protecting the Future

The path to financial inclusion isn’t just about access—it’s about safety, trust, and shared responsibility. Tala continues to push for stronger fraud prevention measures while making sure Filipinos are equipped to protect themselves in the digital world.

Whether through technology, education, or partnerships, Tala is committed to fighting fraud at every level—and creating a future where every Filipino can move forward with confidence.