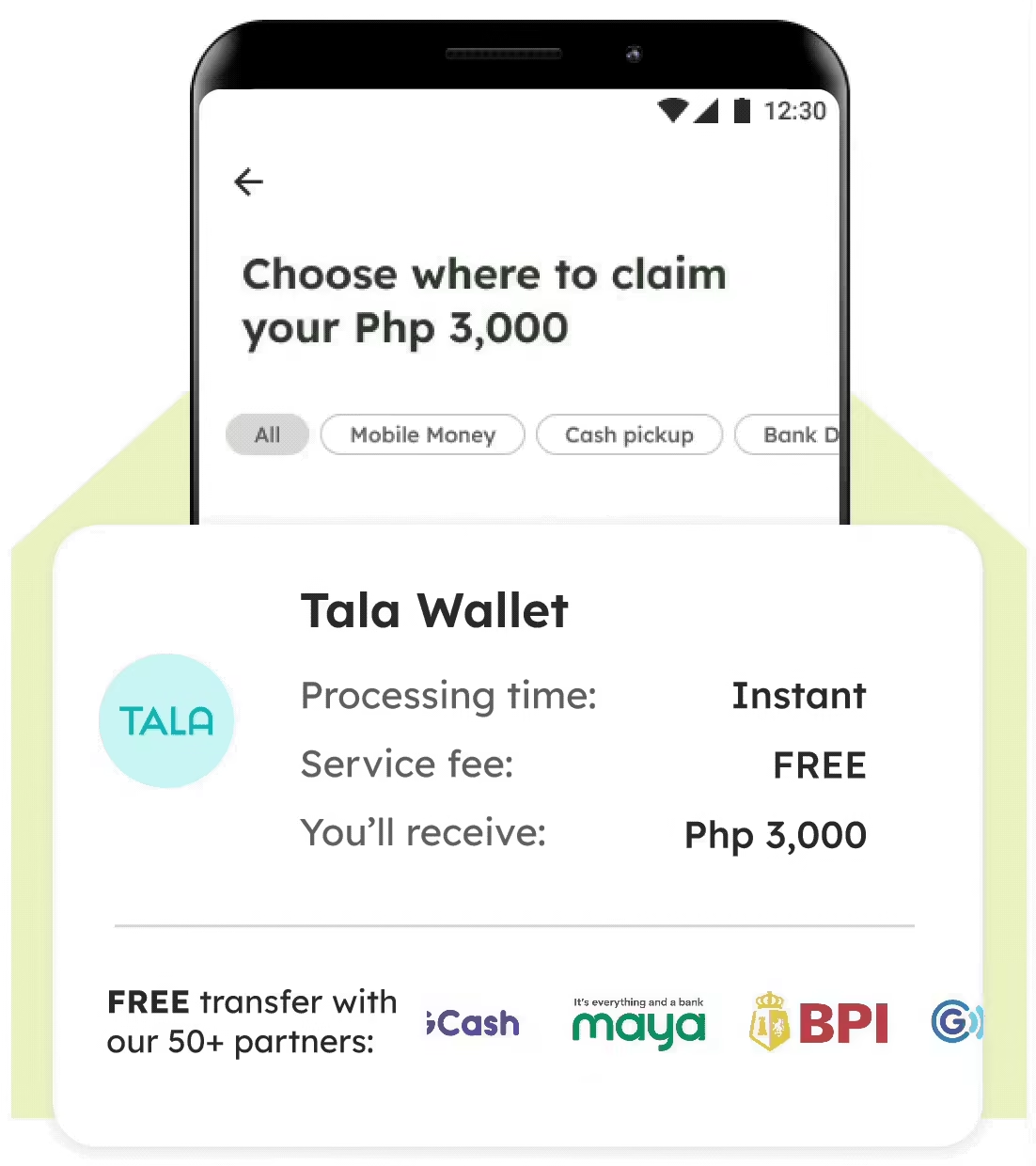

The Tala Wallet saves you time and money

We make it easy to do more with the Tala Wallet. Borrow, pay, and send. Sa Tala, pwede!

Maximizing your credit,

made easy with Tala Wallet

- Receive credit to your wallet instantly

- Pay bills for hundreds of available billers

- 24/7 free InstaPay transfers

- Grow your credit limit faster

The Tala Wallet gives you access to all of this, plus there is no minimum balance required.

All within the Tala app.

Simply put, the Tala Wallet will save you time and money.

How it works

Download and open your wallet from the Tala app

Download or open the Tala app, and click on Tala Wallet. Follow a few easy steps from there.

Borrow and deposit

funds

When you apply for credit, you can select your Tala Wallet as your deposit channel. Or follow the instructions to transfer funds to your wallet easily.

Use your money

how you’d like

Enjoy free cash transfers to e-wallets and banks, or pay your bills instantly using your Tala Wallet.

Grow your

credit limit

Tala Wallet holders can grow their credit limits faster. Get started today!

Protecting your money and data

Not approved for credit yet? No problem!

Frequently Asked Questions

The Tala Wallet is a new mobile wallet that offers you a convenient and secure way to add and transfer cash, pay bills, build your savings goals, and unlock exclusive Tala benefits.

The Tala Wallet is an e-money instrument issued by the UnionBank of the Philippines. UnionBank and EON are regulated by the Bangko Sentral ng Pilipinas (BSP) with email address consumeraffairs@bsp.gov.ph. For more information on Unionbank, click here.

- Disburse the money you borrowed from Tala quickly and for free

- Transfer cash quickly and for free, 24/7, via InstaPay

- Pay bills for Meralco, Shopee, Maynilad, PLDT, and hundreds of other billers

- Keep and save your cash in a safe and secure system

- Repay Tala instantly and for free

You can easily add funds to your Tala Wallet through the following:

- Digital channels

- E-wallets: GCash, Maya, Coins.ph, GrabPay

- Bank apps via InstaPay: BDO app, BPI QuickPay, etc.

- Physical cash in centers:

- 7-Eleven or UnionBank branches

To cash in, simply follow these steps:

- Log in to your Tala app and go to your Tala Wallet.

- Select “cash in” and choose your preferred cash in channel.

- Follow the additional instructions that are shown in-app.

Yes, you can. Once your Tala Wallet has a balance, simply follow these steps to pay bills:

- Log in to your Tala app and go to your Tala Wallet.

- Select “pay bills” and choose a biller category e.g. water, electricity, etc.

- Search for the biller you want to pay and enter the requested information.

- Once your payment is successful, you’ll receive confirmation via text and email