Elaine

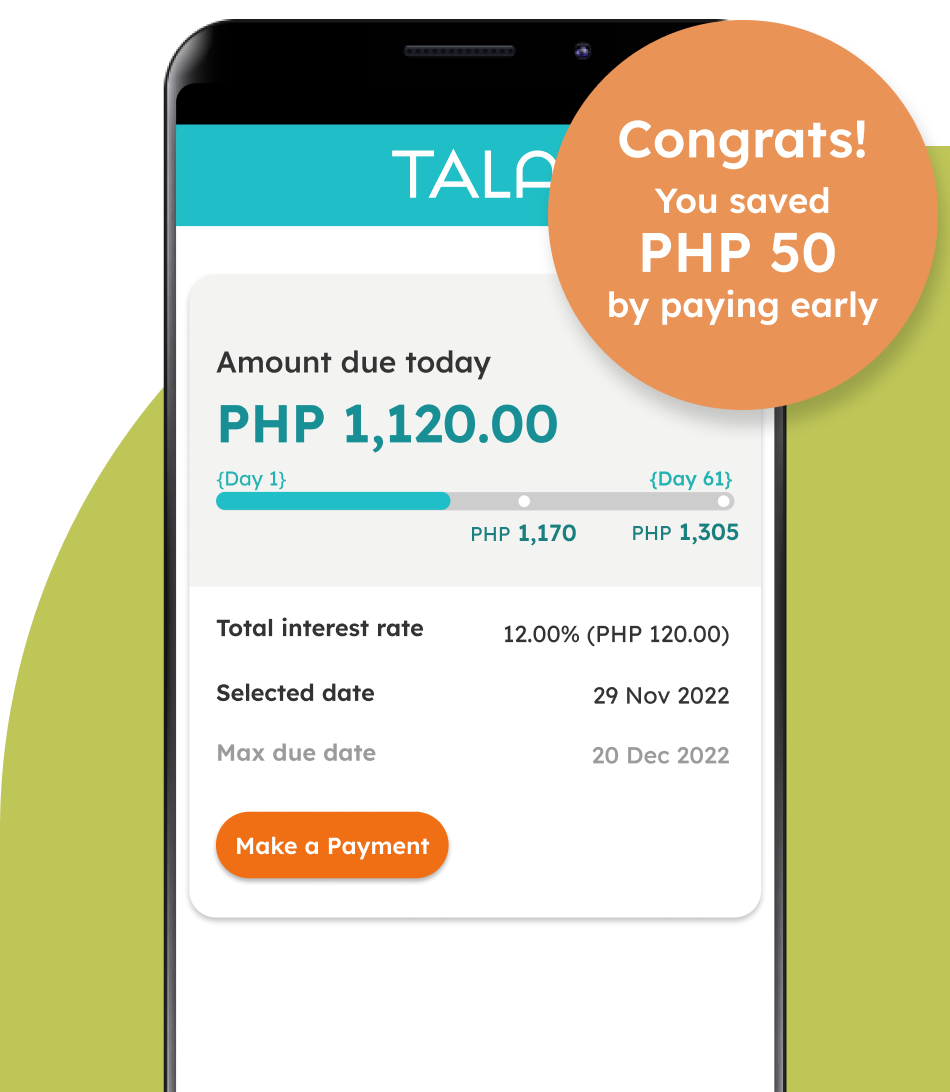

Tala is the #1 loan app for me! Pwedeng magbayad in 1 week, 1 month, o mas mahaba pa. Ang maganda, the earlier you pay, mas mababa ang babayaran. Malaking tulong talaga ang Tala!

Mag-register sa app and sagutan lamang ang ilang katanungan. No bank account or paperwork required. May sagot agad-agad!

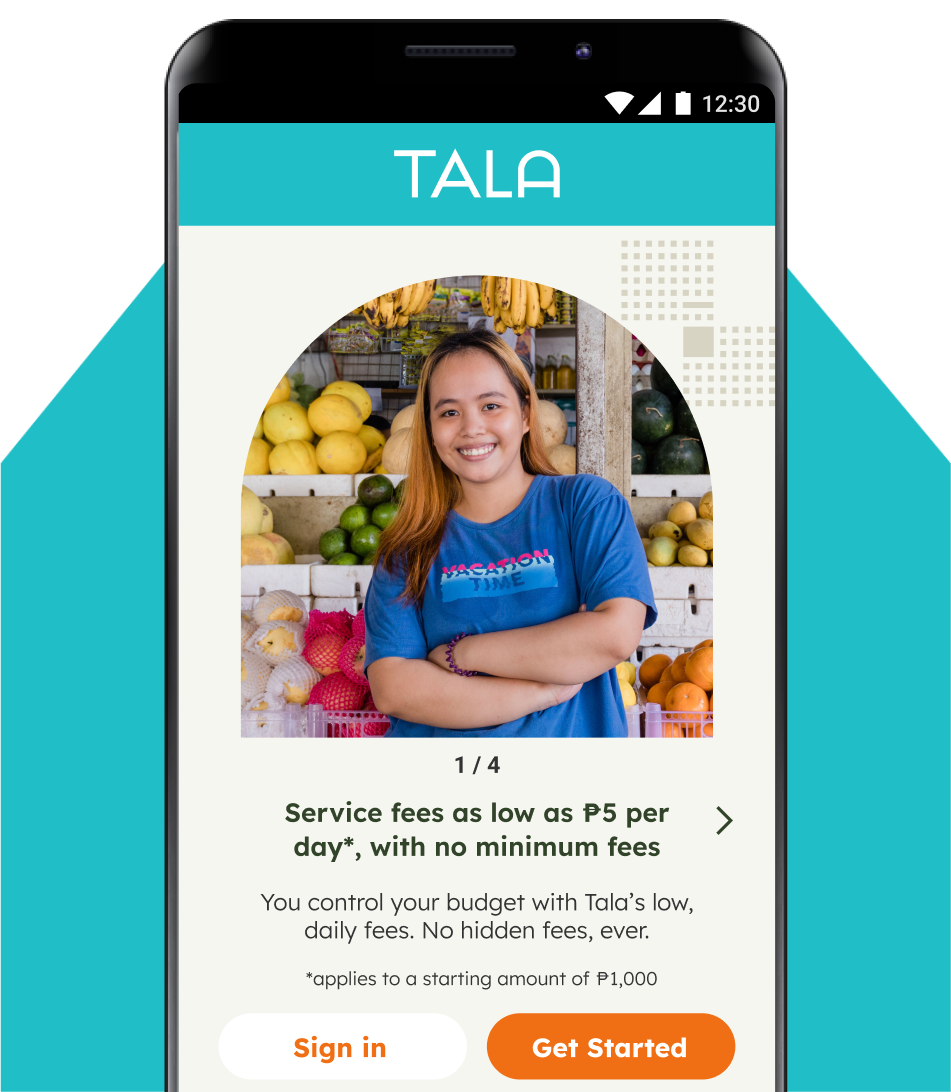

Congratulations, approved ka na! Piliin ang ‘yong sariling loan terms with flat fees as low as 0.5%, no surprises.

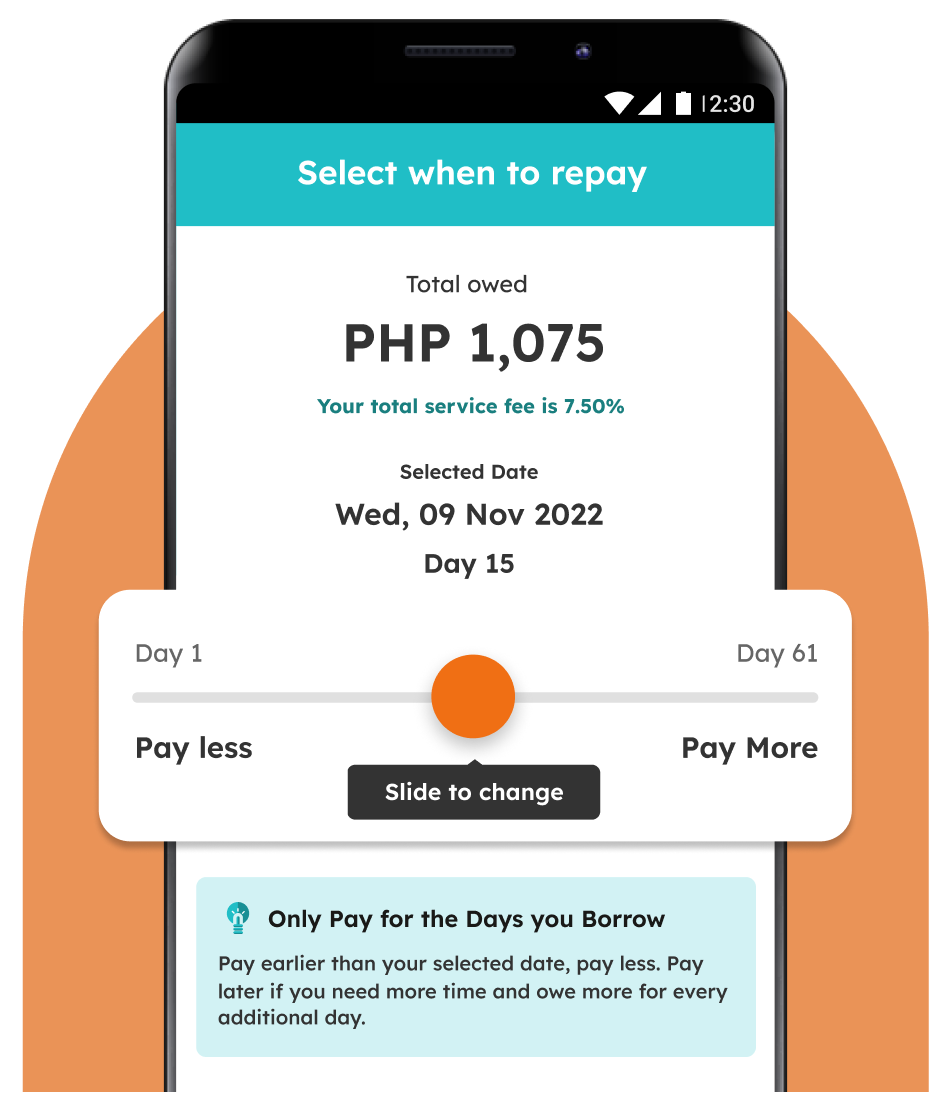

Pumili ng hanggang 61 araw para sa takdang petsa ng iyong utang.

Cash out and repay sa aming authorized channels. Magbayad on time para triplehin ang ‘yong loan limits sa loob ng ilang buwan!

Tala is the #1 loan app for me! Pwedeng magbayad in 1 week, 1 month, o mas mahaba pa. Ang maganda, the earlier you pay, mas mababa ang babayaran. Malaking tulong talaga ang Tala!

Tumagal kami sa Tala dahil maganda ang serbisyo nila. Pang-18th loan ko na ngayon! Mabilis sila at maaasahan. Customer service is also very nice at talgang mababait at maunawain ang mga agent nila.

Sila ang kauna-unahang nagbigay ng loan approval sa akin. Mula noon, naging loyal customer na ako since 2018. Maayos ang pakikitungo nila at may respeto sila sa customers. Salamat sa tiwala, Tala!

PERSONAL LINE OF CREDIT TERMS

• Credit limit amounts: ₱1,000 to ₱15,000

• Service Fee: 0.5% – 30.50%

• Monthly EIR: 15.00%

• Maximum Annual Percentage Rate (APR): 182.5%

• Late fee: one-time fee of 5% of outstanding amount due

• Applicable Tax (DST & GRT): N/A

• Maximum repayment period = 61 days

• Minimum repayment period = 61 days

Example fee: For a borrower who receives ₱4,000 from Tala and repays after 61 days, they would need to pay service fees of 30.50% (or ₱ 1,400), for a total payment of ₱ 5,400

• ₱4,000 (borrowed amount) + ₱1,400 (service) = ₱ 5,400 (total payment)

DISCLAIMER: Tala is not a short-term personal loans app. We provide recurring assess to cash access in the form of a revolving personal credit line.

LOOK FOR TALA IN THE LIST OF SEC REGISTERED LENDING PLATFORMS

For any questions or concerns, please visit gotala.co/help or interact through the official Tala app. Tala is operated by Tala Financing Philippines Inc., a licensed financing company with SEC Registration No. CS201710582 and Certificate of Authority No. 1132, and a registered operator of payment system, with OPS Registration No. OPSCOR-2023-0010. Always study the terms and conditions and the disclosure statement before proceeding with any transaction. Tala is regulated by the Securities and Exchange Commission, with email address at flcd_queries@sec.gov.ph.

The Tala Wallet is an e-money instrument issued by the UnionBank of the Philippines. E-money does not earn interest and is not considered a deposit, hence it is not insured with the PDIC. UnionBank and EON are regulated by the Bangko Sentral ng Pilipinas (BSP) with email address consumeraffairs@bsp.gov.ph.