Tala shares smart tips to handle your loans

September 23, 2021

According to the Bangko Sentral ng Pilipinas, financial literacy in the Philippines remains low, citing that about half of Filipino adults were unable to correctly answer questions that test their knowledge on the impact of inflation on their purchasing power.”1 The question is: How smart are you at handling your own loans and finances?

As a member of the FinTech Alliance committed to fair and ethical lending, Tala shares four habit-forming tips to help you get a grasp of your loans and finances:

- Borrow only what you need. Plan for your loan and assess what you need the credit for. Make sure to separate wants and needs. The Tala app can lend you money, whether it is for tuition fees, a new device for work, or even the week’s groceries. Apply and get a decision in minutes to loans from PHP1000 to PHP 15,000 with reasonable interest rates at either 11.4% or 15.2% depending on the repayment period.

- Assess how much you can pay. Check how much you can pay back in a timely manner by keeping track of your cash flow or how much funds are coming into and out of your finances. Sources of income such as work, business and side hustles should be considered.

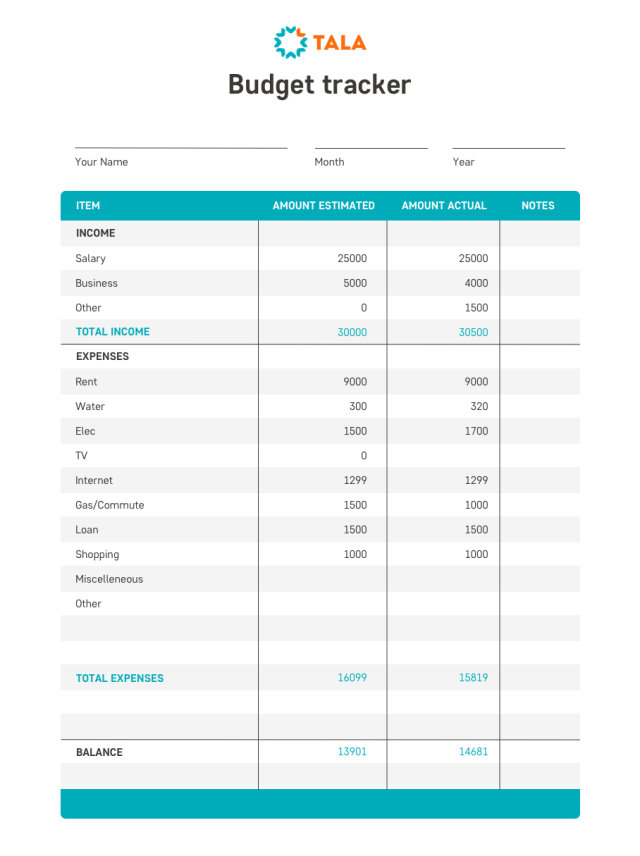

- Use the right tools to track your finances. Applying for loans is made easy with the right tools. To make matters more simple, keeping a budget tracker can help you make sure that you not only get to set aside money for expenses like timely loan repayments, but that you avoid overspending too. When it comes to paying on time, simply check the Tala app to easily view loan deadlines.

- Borrow money conveniently and grow with a trusted financial partner. With the Tala app, you only need an Android smartphone and one valid ID. First-time users of the app can quickly borrow anywhere from Php 1,000 to Php 2,000. By consistently making loan payments on time, you can then eventually borrow up to Php 15,000. These loans can be cashed out in as little as 24 hours through padala center locations nationwide including 7-Eleven, Cebuana, M Lhuillier, and even through one’s own bank account or through the Coins.ph.Tala also provides free financial education, offering access to robust libraries of tailored educational content and in-person & online communities to help Tala users connect and learn from each other.

Tala loans empower you with flexible financial access and the opportunity for growth. Whether you rely on Tala on a regular basis to supplement your income or you simply want to increase your access to credit to prepare for a rainy day, you can count on Tala to help you build financial security and agency.

“At Tala, we aim to help our fellow Filipinos manage their daily expenses and finances. Through the app, we hope they can get the loan they need securely in their time of need. We’re not a simple loan provider – we strive to be your financial partner and help guide you through the ups and downs of managing your finances” says Angelo Madrid, Managing Director of Tala PH.

Tala, a global financial technology company trusted by 6 million worldwide in enabling and accelerating financial health, expanded to the Philippines in 2017 and now has 1.6 million Filipino customers. To start your journey, visit the Google Play Store now to download the app and learn why it has over 1 million 5-star reviews globally by clicking bit.ly/3jMEjEm.

1. Retrieved from: https://www.pna.gov.ph/articles/1141000

Your secure and trusted financial partner, Tala is operated by Tala Financing Philippines Inc., a licensed financing company with SEC Registration No. CS201710582 and Certificate of Authority No. 1132. Always study the terms and conditions and the disclosure statement before proceeding with any loan transaction.